Originally posted on April 29, 2012.

Whenever I am in Amsterdam, I go to a bookstore and browse the second-hand shelves in the economics section. Recently I found two books by Dr. Jelle Zijlstra: “Dr. Jelle Zijlstra, Conversations and Writings” (1979, second edition) and “Per Slot Van Rekening” (1992, fifth edition). The latter title is a Dutch figure of speech that may be translated as “The Final Settlement.”

Jelle Zijlstra was a renowned Dutch economist and one of Holland’s finer statesmen. Early in his career in 1948, shortly after World War II, he became a professor, specializing in the velocity of money. By 1952 he was appointed minister of economic affairs, then Dutch treasurer from 1958 to 1963 and again from 1966 to 1967. During his last term as treasurer he led the Dutch Cabinet as prime minister as well until 1967, after which he became president of De Nederlandsche Bank (DNB). While president of the Dutch central bank he was appointed as the president of the Bank for International Settlements (BIS) as well, positions he held until his resignation in 1981.

You can read a little about this extraordinary man at Wikipedia here.

In Zijlstra’s first book, “Dr. Zijlstra,” he writes about his career and his time as president of De Nederlandsche Bank and the BIS. While he was DNB president the international Bretton Woods agreement collapsed, and he goes into great detail about what happened. He writes about the “European” group’s interests, about the cultural and financial ties between Germany and the Netherlands, the relationships with France and Great Britain, and, of course, about the position of the United States.

It gets especially interesting when Zijlstra writes about then-U.S. Treasury Undersecretary Paul Volcker and Federal Reserve Board member Dewey Daane of the Richmond Federal Reserve Bank. On the July 7, 1971, Volcker and Daane arrived in Amsterdam to urge the Dutch government not to convert any more of its dollar reserves into gold.

Zijlstra writes (p. 191): “From the beginning of 1971 we had already converted almost $600 million in return for gold or an asset on an equal footing.”

This phrase — “an asset on an equal footing” — is peculiar, since from an investor’s or central banker’s perspective there is no equivalent to physical gold. Let this be very clear: There is no asset that stands on equal footing with gold. You either own it or you do not.

But central bank balance sheets account for official gold reserves under the description “gold and gold receivables” and apparently have done so back to times before Zijlstra became a central banker, before Bretton Woods collapsed. This is quite revealing.

In the eyes of gold bugs, “gold receivables” is a bit of a contradiction in terms and has been the cause for much suspicion. Can we really trust the numbers on central bank balance sheets?

The essence of this question is one of accounting, because gold reserves are either “allocated” or “unallocated.”

The big difference is that when gold is “allocated” one has legal title to specific metal vaulted by someone else. But when gold is “unallocated” one has merely a fiduciary claim on a future delivery of gold. This implies counterparty risk.

Zijlstra and Volcker: “Monetary Adversaries”

As an economist, I knew of the visit by the U.S. officials in 1971. It is remembered by many Dutch economists because of Zijlstra’s famous anecdote about a conversation he had with Volcker, who went on to become Fed chairman.

When Volcker visited Zijlstra as Treasury undersecretary, Volcker said, “You are rocking the boat.” Zijlstra replied: “If the boat is rocking because we present $250 million for conversion into gold or something that can be considered an equal asset, then the boat has already perished.” (P. 191.)

Zijlstra refused to heed the U.S. request and converted DNB’s dollar holdings for gold. And since the reasons behind this “heavy American delegation” — as he described it — were quite obvious, he suspected that the gathering storm he had foreseen for some years was about to break loose. Or, as we say these days, he knew that “the fiat was about to hit the fan.”

A Man of Precision and Conviction

Also interesting about Zijlstra’s first book is that he is very detailed and precise in explaining his views. For example, he describes inflation as “the most gross social injustice” which “hits the less fortunate the most,” and he practiced what he preached.

He explains how, as Dutch treasurer (1958-63 and 1966-67) he managed his Cabinet to be fiscally prudent, which he connects to his opposition to inflationary policies. To illustrate his objections, in his second book he writes:

“Despite an additional flow of funds due to increasing returns on Dutch natural gas reserves and the second oil crisis, this Cabinet also proved it could grow hungrier while eating.”

Also, and in this respect very typically, he defines the Dutch guilder in terms of gold: “F. 1 = 0.334987 grams of fine gold” (p. 181), and in a footnote on this page he included the numbers needed to calculate the value of the guilder after the 1978 devaluation: 0.13333 grams of fine gold.

This points out something really important. Why does a central banker, a former BIS president, calculate the value of his currency in terms of gold when gold backing had been officially removed?

“The Final Settlement”

In Zijlstra’s second book, “Per Slot Van Rekening,” we find a very candid man, even contrarian. He gives a very precise description of how central bankers conduct their business and maintain their independence from government interference.

This makes this particular book so refreshing. For example, whereas conventionally monetary debasement is described euphemistically, Zijlstra explains what central bankers actually do, and more importantly, acknowledges that the price of gold is kept far too low.

Central bankers have thus known what gold bugs long have been saying. Let me take this one step at the time. Dr. Zijlstra writes that revaluing is “‘putting a bit more gold in your currency’ so it becomes more valuable than other currencies. Summarizing: it is about the choice between ‘adjustment’ inflation or revaluation. Germany decided to revalue the German deutschemark on March 3, 1961, with 5 percent; we decided … to follow. To my regret, then and still, Germany did not revalue more; I would have defended a revaluation of 10 percent zealously if Germany would have done so. … A devaluation was more or less seen as a defeat, a testimonium paupertatis for a country.” (p. 220.)

Now that’s a really honest way of explaining currency devaluation.

But it gets far more interesting. Zijlstra explains his understanding of the role of gold in what he eloquently calls the international “monetary cosmos”: Gold functions like the sun, with all currencies as planets orbiting around it, with only the sun in fixed position:

“… It is perhaps nice to get into the role of gold and its meaning in the time before the monetary cosmos collapsed into more chaotic conditions. Throughout centuries gold was a protection against [natural] disasters, arbitrariness, and persecution. … Because natural production levels hardly allow overproduction with substantial depreciating values as result; because it does not rust and, once produced, never perishes, excessive scarcity can never occur. That’s why gold developed its image of solidity, stability, and reliability. … Gold coins then have been used over the centuries as means of exchange in primitive currency frameworks and were later, with the development of paper money, seen as a reliable basis. In the heydey of the gold standard one could take a banknote to the central bank and — if you would like that — get gold in return. The famous Englishman Bernard Shaw once said one has the choice between the natural stability of gold and the natural stability of honesty and intelligence of government. And he was of the opinion this choice was not hard.” (p. 221.)

Zijlstra explains how all this was relevant during his time as president of the DNB and during his presidency of the BIS. He explains that the United States was debasing the dollar. Most interestingly, Zijlstra writes about his idea of a solution for the “international chaotic non-arrangements”:

“A good solution would have been to drastically raise the price of gold, since it was extraordinarily peculiar that in the post-World War II world, in which everything became more than three to four times more expensive than in the 1930s, the price of gold remained the same. Actually, two things had to be done. The official gold price in all currencies had to be raised (‘their gold content had to be reduced’) and, beside this, the official dollar price of gold had to be raised extra, to allow the dollar to devalue against all other currencies”. (p. 222.)

Zijlstra writes about the American reaction to his proposals:

“However, the Americans found this idea like swearing in a cathedral. Because, by that, the dollar would in regard to gold become second, and the American ideal was and is to have the dollar central in its role on the economic stage. As a consequence, there was only one exit and that was cutting the tie between the dollar and gold. That would eventually happen in August 1971 when President Nixon announced that the dollar was no longer convertible into gold. After increasing American pressure, step by step, the actual convertibility of dollars in gold was curtailed until it was formally ended.” (p. 222.)

But it gets even more interesting. Zijlstra wittingly or unwittingly confesses what most gold bugs assert. He writes: “An important step on this road was the creation of a whole new international monetary instrument, the SDR (Special Drawing Rights). This is about an inventive construction whereby ‘something’ is created out of ‘nothing.’ The International Monetary Fund would — through precise administrative procedures — create rights on the fund, with which central banks can settle their payments among each other. Those rights would — according to certain measurements — be credited to the members of the fund. The idea behind this was that it was expected that in due time there would be too little gold (I am inclined to say: what do you expect with such an artificially maintained, much too low gold price) to serve as ‘international means of settlement.'” (p. 222.)

This speaks for itself, but just in case you missed the elephant in the room of international finance, Zijlstra writes, even if it is in a mere aside, “Gold is artificially kept at a far too low price.”

He continues that the introduction of SDRs in 1967 was warmly welcomed, becoming soon “a fantasy for intellectuals” to have the SDR perform the function of the sun in the “monetary cosmos.” But despite this warm welcome, the SDR went the way of the dodo bird.

Zijlstra elaborates about the SDR that in the late 1980s and early 1990s, “we do not hear much of it. At first, it appeared as if the foremost Americans were enthusiastic proponents of this new international monetary instrument, but this proved to be pretence. They welcomed the SDR to move gold even further away. As soon as gold was removed as a central point in the international monetary framework, their love for the SDR disappeared. The SDR has become a piece for a museum.” (p. 223.)

And: “But in case there is no complete international means of settlement, no gold, no SDR, wherein should central banks settle? The logical end-piece of this development was giving up on fixed parities” to gold. “The currencies are currently exchanged on international markets. The resulting prices bring supply and demand in balance and there is no way of settling. No more cosmos, no sun with planets: All currencies are formally equal. One can buy and sell them on international currency markets.” (p. 223.)

“It may be so that in the formal sense of currencies one can say that all are equal, but that in reality it proves that some are more equal than others. The dollar is back as the material core of the international financial and monetary arrangements. That the countries of the EEG [currently the EU] have begun constructing their own monetary cosmos, I have mentioned already.” (p. 223.)

What most pundits are missing about Europe and the euro is what Zijlstra refers to: The euro has been established as a solution and is orbiting gold. Now if you took notice of the consolidated European Central Bank’s system-wide balance sheet — see here — you can figure the shadow value of one euro in terms of grams of fine gold much as Zijlstra explains in his books.

According to my calculation, with the ECB’s gold holdings at 502.5 tons of gold, divided by the number of euros in circulation (note how all other balance sheet items are “denominated”), one will find that 1 troy ounce is worth the equivalent of around E55,000.

And that’s what you really want to make use of — that is — after everything else has failed. If there emerges an absolute need to fix the financial crisis, you can be sure of one thing: We’ll have a pricing mechanism for physical gold at least.

In tragedy lies humor

Even humor finds its way into Zijlstra’s second book, and something that is quite revealing as well. It also illustrates his adversarial relationship with Volcker, if one of a professional nature.

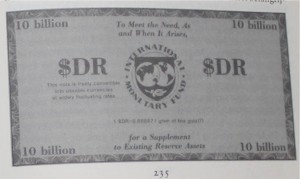

When Zijlstra stepped down from the BIS presidency in 1981, Volcker, then chairman of the Fed, gave Zijlstra an “$DR Note of 10 billion” depicted here:

The note is dated December 1981, carries a photo of Zijlstra’s face, is signed by Volcker, and bears the legend: “The Fund May Prescribe … As Holders … Institutions [and Persons] that … Perform Functions of a Central Bank for More than One Member.”

Zijlstra writes: “This gift has become a lasting memory of the feelings on both sides: It will never be something, respectively, it may never be something with the SDR.”(p. 234.)

Knowing his religious and, more generally, his Dutch background, I think this was Zijlstra’s way of saying he appreciated Volcker’s reflection and irony.

The other side of the mock SDR note says: “To Meet the Need, As and When It Arises, for a Supplement to Existing Reserve Assets.” In between it says: “1 SDR = 0.8886671 gram of fine gold(?).”

We’ll have to check some numbers, but perhaps we should make a contest for gold bugs to determine what’s behind this calculation. For the question mark says a lot: Behind the scenes, central bankers were still discussing their currency values in terms of gold, at least into 1981 when Zijlstra stepped down as president of the BIS.

By the way, on the left side of the mock SDR note, it says in small print: “This note is freely convertible into useable currencies at widely fluctuating rates.” Zijlstra must have thought: “Funny money indeed!”

Conclusion

All this information Zijlstra shared in his books is quite something. During his terms in office central banks were converting their dollars into something other than real gold in possession and probably did so all along from the start of the Bretton Woods agreement in 1944. An asset “on an equal footing of gold” makes you think: You either have possession or not. Apparently central banks converted their dollars into something “funny.”

A real giveaway is that Zijlstra wrote this in the 1990s: “The gold price is artificially kept far too low.” And most important, he has provided all the necessary information to reach the conclusion that central bankers are always evaluating their currency in terms of gold.

Why? Because, before and after all has failed, gold is the sun in our “monetary cosmos.”

As a central banker Zijlstra was a statesman in heart and mind. His legacy and his insights are a tribute to honesty. He explained that we must not think of the dollar or any other currency as the sun of the “monetary cosmos” — not anything but gold. Not the SDR either, just gold.

This, in my opinion, is the essential point Zijlstra is conveying.

He will not speak further. He died in 2001. May he rest in peace. He provided us with an enduring lesson. Two things were needed back then but are ever more desperately needed now.

The official gold price in all currencies had to be raised (“their gold content had to be reduced”) and the official dollar price of gold had to be raised extra, “to allow the dollar to devalue against all other currencies,” to quote Dr. Zijlstra a final time.

Now you know why you should own some physical gold. It is like the sun, which, in the end, we are all circling, whether we do so consciously, with acknowledgment, or in denial.

—-

Sources included: Jelle Zijlstra (1979), “Dr. Jelle Zijlstra — Gesprekken en Geschriften samengesteld door Dr. G. Puchinger met bijdragen van Dr. W. Drees Sr.,” Strengholt’s Boeken (Naarden), second edition; ISBN: 90-6010-430-7, and Jelle Zijlstra (1992), “Per slot van rekening”, Uitgeverij Contact (Amsterdam), fifth Edition; ISBN: 90-254-0181-3. The author is long physical gold (and silver) only.

That Zijlstra didn’t speak anymore we don’t know , it looks like to me that the famous “another” may be quite close to Mr Zijlstra

Haha, could be, could be not. Perhaps if we had access to the NSA databases, we could find out (sarcasm intended :P).

Anyhow, I think it does not matter whether they were related. I think it is the merit of the analysis that counts. The thoughts of Another speak for themselves and likewise Zijlstra’s. And to take the lesson of a friend at heart: never take the fun out of an equation. Not knowing who Another was, makes the speculation more fun.

Nice post and find, I also had Zijlstra as candidate for “another”, more recently I tend a bit more towards Alexandre Lamfalussy. The thoughts are similar, but then again maybe the BIS boys think more or less alike?

Nice! Congrats.